Equitable E-Mobility Rebate Program Now Accepting Applications!

Now Honoring Electric Vehicle and E-Bike Purchases from 4/1/23

The Equitable E-Mobility Rebate Program is a direct result of funding through the Bi-Partisan Infrastructure Law State Energy Program grant# SE0010105 which is a testament to President Bidens initiative to make clean technology more accessible. The program is effective for purchases made on or after April 1st, 2023, and it aims to incentivize the adoption of electric vehicles (EVs) and electric bicycles (e-bikes) by offering substantial rebates to residents of the US Virgin Islands. The Equitable E-Mobility Rebate Program is a strategic effort by the Virgin Islands Energy Office to accelerate the transition to clean and sustainable transportation options, contributing to a reduction in carbon emissions and promoting a healthier environment. By providing substantial rebates for both new and used electric vehicles, as well as electric bicycles, we aim to make sustainable mobility options accessible to a broader range of residents. This initiative aligns with our commitment to building a greener and more resilient future and Transportation electrification is a primary conduit to energy resiliency in the Virgin Islands. Rebates will be distributed on a first-come, first-served basis.

Rebate Overview

- $5,000.00 rebate for approved new and used vehicle rebate.

- $500.00 for qualifying E-Bikes from approved vendor.

Program Requirements:

- Be a resident of the US Virgin Islands or a US Virgin Islands small-business, non-profit, or not for profit (excluding dealerships) located and licensed to operate in US Virgin Islands. Proof of US Virgin Islands residency is required to complete a VIEO Equitable E-Mobility Program Rebate Application.

- Be a purchaser of a new or used eligible Battery Electric Vehicle (BEV) purchased at a licensed Automobile Dealership in the Virgin Islands or at a licensed Out-Of-Territory dealership with a final purchase price at or below the final sales and purchase price agreement of $65,000.00† for new vehicles, and $40,000.00‡ for used vehicles with under 20,000 miles.

- † $65,000.00 price cap does not include taxes, registration fees, delivery fees, incentives, or rebates, etc.

- ‡ $40,000.00 price cap does not include taxes, registration fees, delivery fees, incentives, or rebates, etc.

- Applications for used EVs that are within a maximum of four (4) model years old from date of purchase will be deemed eligible. For instance, in 2024, used EV purchases including model years 2020 to 2024 will be acceptable, and this pattern will persist until funds are exhausted. Electric Vehicles must have minimum battery capacity of 20 KWh

- Be a purchaser of a qualifying new E-Bike from an approved local vendor.

- Used vehicles must have a clean title, i.e., no salvaged, junk, reconstructed, rebuilt, water damaged, or dismantled titles.

- Must Maintain ownership of this EV or E-Bike for at least three (3) years.

Rebate Limitations:

- VIEO Equitable E-Mobility Program Rebates are limited to one (1) application per household (i.e., individuals) and two (2) applications per business entity (i.e., small-business, non-profit or not for profit, (excluding dealerships).

- Rebates will be distributed on a first-come, first-served basis and issued to qualifying Rebates are subject to availability of funds through the SEPBIL Grant EE0010105, VIEO Equitable E-Mobility Program Rebate.

In addition to the rebate amounts some vehicles may also qualify for Tax Credits through the IRS (click here to visit the tax credit eligibility landing page).

EV Required Supporting Documentation:

- Completed W-9 form

- USVI Government issued ID:

- If applying as an individual, a copy of the applicant’s Valid US Virgin Islands driver’s license or Valid Driver’s License and copy of stamped USVI Tax Return.

- If applying as an organization, such as a small-business, non-profit, or Not-for-Profit (excluding dealerships) Organization a copy of a local business license is required.

- A copy of the executed and signed vehicle purchase agreement

- Copy of Electric Vehicle Title or Lien Letter

- Active USVI Auto Registration

- Signed VIEO Equitable E-Mobility Rebate Terms and Conditions

E-Bike Required Supporting Documentation:

- Completed W-9 form

- USVI Government issued ID:

- If applying as an individual, a copy of the applicant’s Valid US Virgin Islands driver’s license or Valid Driver’s License and copy of stamped USVI Tax Return.

- If applying as an organization, such as a small-business, non-profit, or Not-for-Profit (excluding dealerships) Organization a copy of a local business license is required.

- A copy of the E-Bike Receipt

- Signed VIEO Equitable E-Mobility Rebate Terms and Conditions

Current E-Bike Qualified Vendor – Island Life Adventures – St. Croix

Once you have compiled all of the above required documents please complete an Equitable E-mobility Application from the documents section below or click on the image below to complete an online application.

E-Mobility Supporting Documents

Frequently Asked Questions

How do I ship a vehicle here?

A. Freight forwarders have varying levels of requirements, costs and stipulations as it pertains to shipping EVs into the territory. These requirements may change so the VIEO highly advises that you reach out to your chosen freight forwarder to ensure you are clear on the requirements.

Where do I charge an EV if I get one?

A. Generally when purchasing an EV you must also consider an at home charging solution for the vehicle to ensure you can have adequate charge for your driving needs. The VIEO recommends installing a phase 2 charging station at your residence to ensure consistent charging. Public charging stations will be installed throughout the territory in 2024 as well with continued plans for additional installations into the future.

Who will service and repair my EV?

A. Currently there are limited options in the territory, however the VIEO is committed to workforce development in the Territory, and this included EV service and repair. We are currently working with the Department of Education to Provide an Automotive Service Excellence L300 (Electric and Hybrid Vehicle) certification course in the Summer of 2024 for local mechanics. Additionally, the VIEO has funding to create an EV garage to support the transition to EV maintenance, service and repair. The same funding will also support the acquisition of needed tools and equipment for existing automotive mechanic facilities in the territory as well.

How do I get a tax credit?

A. Some vehicles are also eligible for tax credits and the IRS has a detailed breakdown at https://www.irs.gov/clean-vehicle-tax-credits that explains the guidelines for both new and used vehicles. It is advisable to discuss this with a tax accountant or tax professional to ensure you can fully utilize the federal tax credit.

Electric Vehicle Owner Testimonials

Deshane Scotland Phillips – BMW i.4

“I am not selling my lil BMW electric car for NO ONE!

I only realized today how spoiled I have been over the past 5 months with this car! I decided to drive my gas car for two days, and I ended up putting in $60 of gas vs. driving on electric for a week before having to charge up again. Mind you, my bill from WAPA has only gone up by $38 a month! DO THE MATH!

ELECTRIC IS THE FUTURE!…. I’m KEEPING HER!… My daughter Demiah loves it too. She calls it a “Silent Bully” because how it easily passes all the loud aggressive cars”

George and Cecile Harrington – Toyota Rav 4 EV

“100% powered by the Caribbean sun! Solar power since 2013. EVs since 2017. Doing our part to keep the USVI’s rating as the best air quality in the world!”

Electric Vehicle Mandates According to Act 7075

Act 7075 set a goal to achieve the territory’s renewable energy potential that would support reaching the renewable energy & energy efficiency goal of 60% by 2025.

Title 12 Chapter 23 Subchapter 3 1129

Section D states

-

“(1) Within 2 years from the effective date of this chapter, the Virgin Islands Energy Office in conjunction with the Department of Property and Procurement shall establish an Energy-Efficient Fleet Management Plan with plans for the acquisition of energy-efficient government fleet of vehicles, consisting of hybrid vehicles, electric vehicles, alternative fuelled vehicles, or vehicles within the top one-fifth of the most energy efficient vehicles in their class. The plan must require that within 10 years from the enactment of this chapter, the plan must be implemented throughout all departments and agencies of the Government of the Virgin Islands.

-

(2) All vehicles purchased after the enactment of this chapter must meet minimum fuel efficient and environmental impact national standards, as regulated by the class of vehicle.

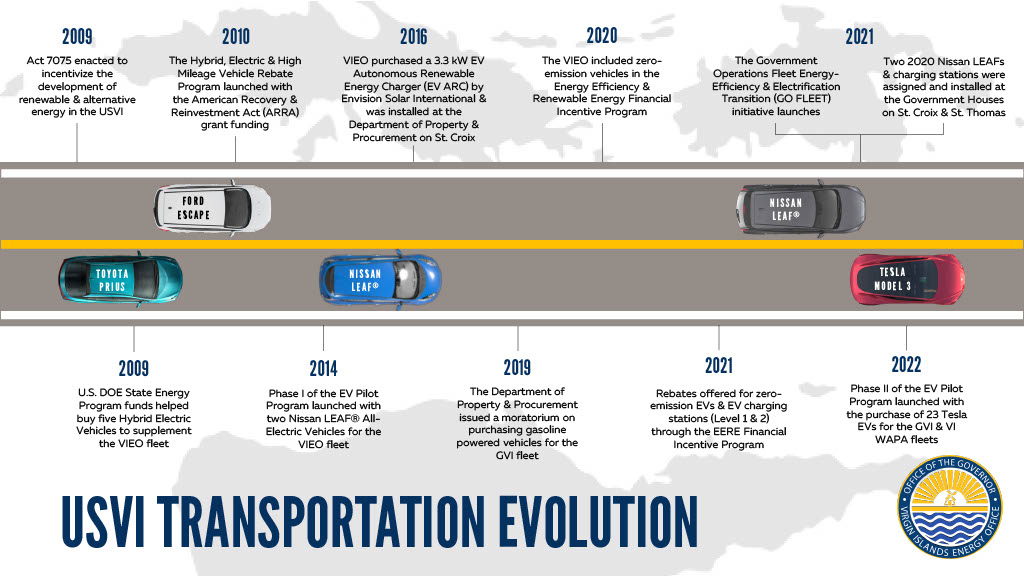

Vehicle Electrification in the Virgin Islands

The United States Virgin Islands (USVI) Transportation Electrification Roadmap (Roadmap) outlines actions that support the accelerated adoption of plug-in electric vehicles (EVs) throughout the territory. Electrifying transportation provides many benefits for residents including reduced costs, improved vehicle reliability and air quality, and an opportunity for a more stable grid.

Click here or on the image of the Electrification Roadmap to download a copy

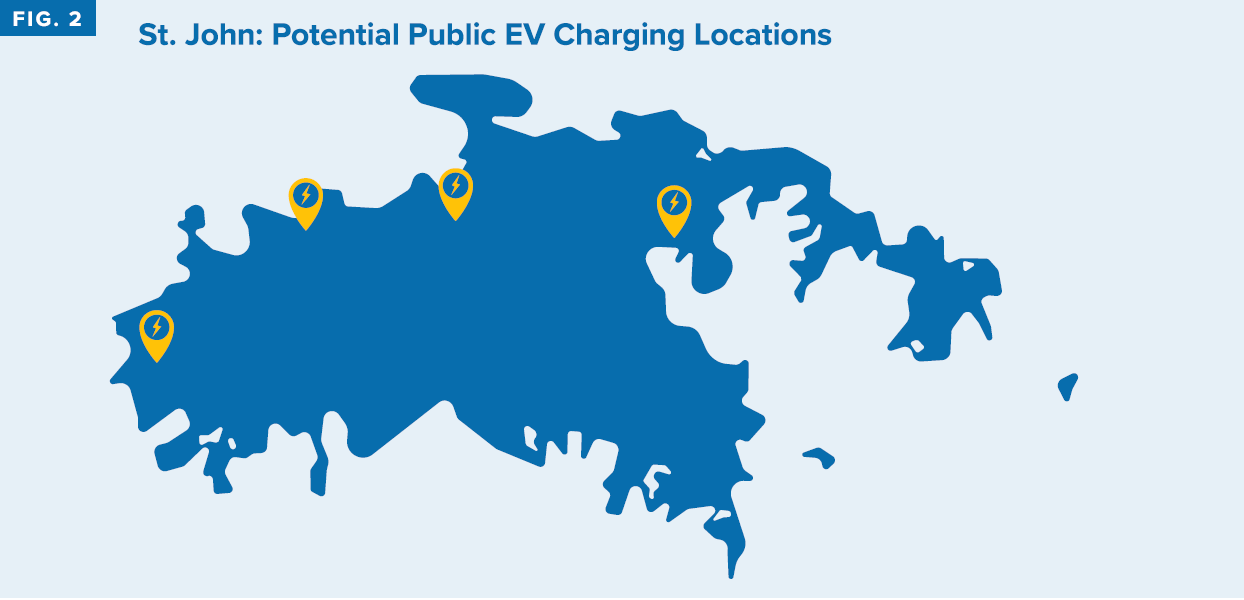

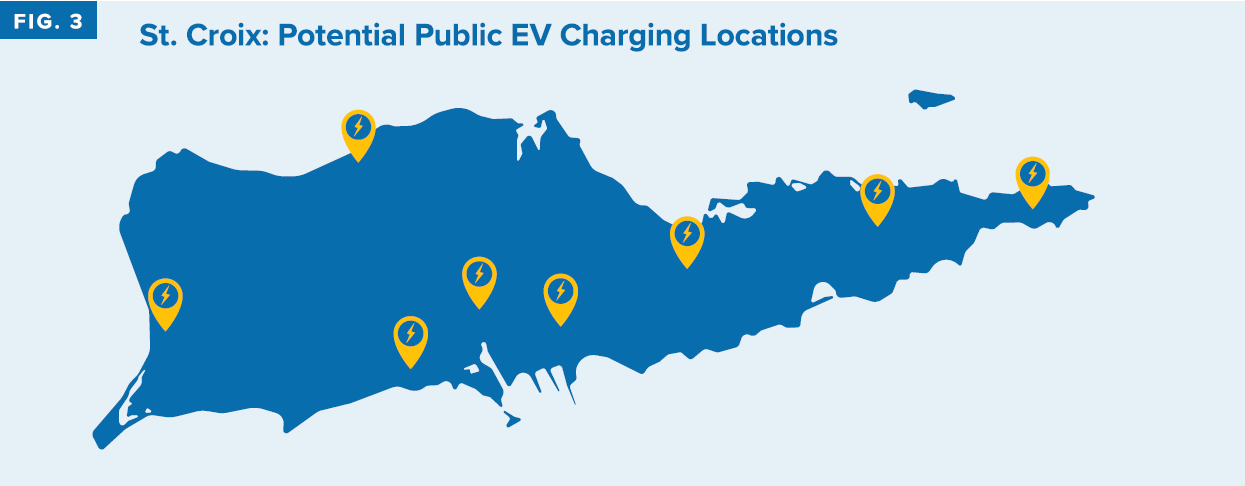

Electric Vehicle Charging

A strategic deployment of Charging Infrastructure is critical to the ensuring the sustainability of the territory’s Transportation Electrification goals. Through federal funding from the US Department of Energy and Department of the Interior the Virgin Islands Energy Office has already begun identifying and deploying a network of Level 2 charging stations across all three islands. The VIEO has been working closely with VIWAPA to identify charging station locations that offer high utilization and low-cost installation to ensure charging access is available from Frederiksted to Point Udall and from Bordeaux to Coral Bay.